Hyper-personalization in banking uses AI and data analytics to deliver highly tailored financial solutions, enhancing customer satisfaction, loyalty, and operational efficiency. While it offers significant advantages like increased revenue and competitive differentiation, challenges such as data security, privacy concerns, and technological investment must be addressed for successful implementation.

Hyper-personalization is a marketing and customer experience strategy that leverages data and AI to deliver highly tailored content, offers, and experiences to individual customers. Unlike basic personalization, such as using a customer’s name, hyper-personalization utilizes real-time insights into behaviors, preferences, and needs to create unique interactions. Examples include customized product recommendations, targeted messaging, and dynamic website content that adapts to individual users.

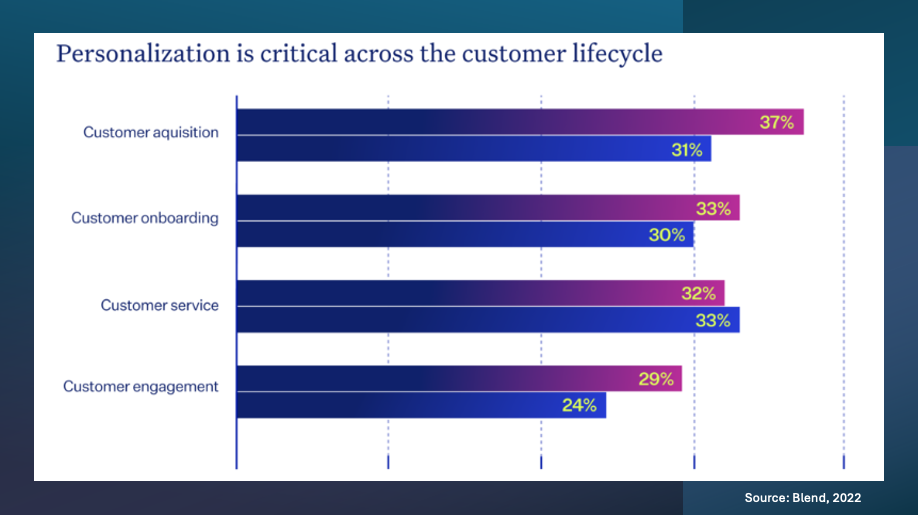

Banks, with their vast repositories of customer data, are particularly well-positioned to benefit from hyper-personalization. Research shows that financial institutions employing AI-driven personalization achieve significant improvements in customer satisfaction. For instance, a 2023 McKinsey study revealed that banks using AI for personalized recommendations experienced a 15% average increase in customer satisfaction scores. By tailoring financial solutions to individual needs, banks foster stronger customer loyalty and retention. A 2022 Bain & Company report indicated that personalization could boost customer lifetime value by up to 20%.

Hyper-personalization relies on collecting and analyzing extensive data. Banks gather this data through mobile apps, online banking platforms, social media, and third parties like credit bureaus. Real-time processing enables the creation of accurate customer profiles, allowing banks to offer solutions even before a client makes a request. This differentiation extends across services, from personalized mortgages to tailored investment advice.

JPMorgan Chase, BBVA, and HSBC Revolutionize Customer Experience with AI and Data

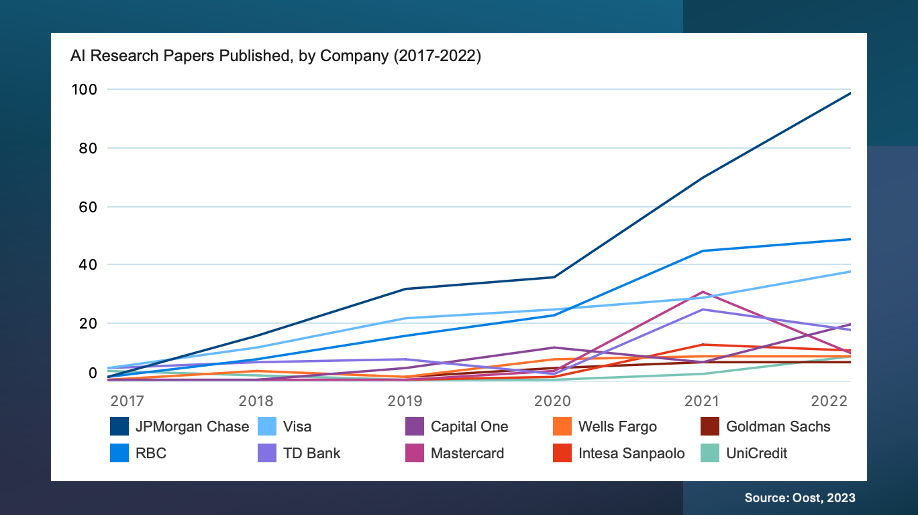

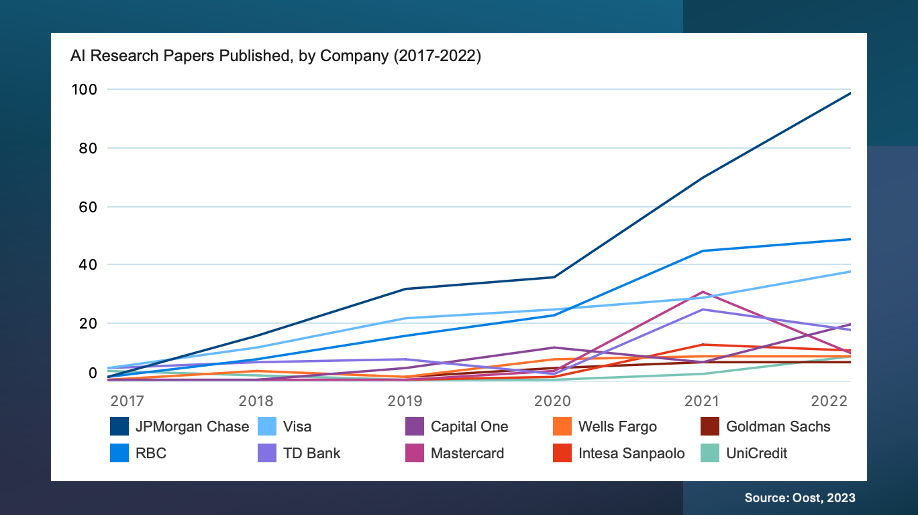

Leading global banks have adopted hyper-personalization strategies, harnessing AI and data analytics to enhance customer experiences. For example, JPMorgan Chase uses AI extensively in investment advisory and wealth management, providing clients with financial health alerts and tailored portfolio suggestions. Studies demonstrate that AI-driven customer segmentation significantly improves retention by delivering customized financial services.

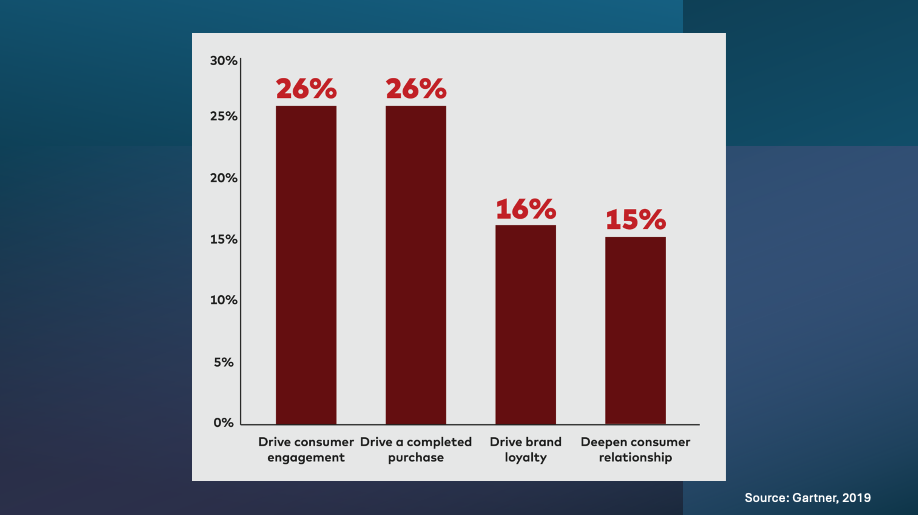

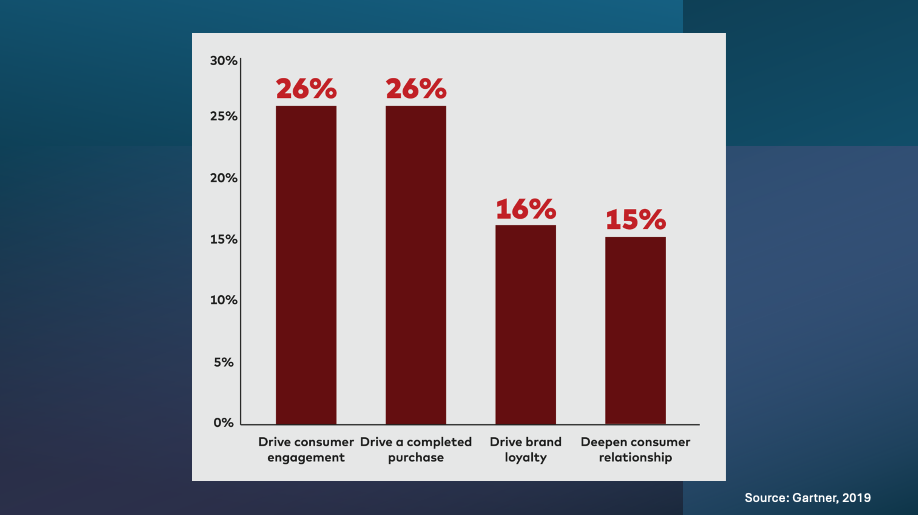

BBVA, a Spanish multinational bank, has integrated hyper-personalization into its digital banking services. Its mobile app employs intelligent algorithms to analyze spending habits, anticipate future needs, and propose dynamic savings plans, budgets, and loans. An Accenture study suggests that enabling personalization technologies can boost revenues by 5%-15% within 2-5 years. Gartner research highlights that the primary goals of personalized marketing campaigns are driving customer engagement and achieving conversions, with additional aims like fostering brand loyalty and deepening customer relationships.

Hyper-personalization also extends to corporate clients. HSBC uses advanced data analytics to design bespoke cash management solutions, enhancing liquidity management and reducing operational costs for businesses. By analyzing transaction patterns and cash flow, HSBC addresses working capital needs, improving satisfaction among corporate clients.

Emerging Opportunities in Hyper-Personalized Banking

Hyper-personalization offers several competitive advantages. One of the most significant benefits is the potential for enhanced customer satisfaction. Customers increasingly expect seamless and effective solutions from their banks. By anticipating their needs and delivering timely, tailored services, hyper-personalization allows banks to exceed expectations and foster trust. Another advantage is the improvement in operational efficiency. AI and machine learning streamline processes, reducing reliance on manual intervention and accelerating service delivery.

Hyper-personalization also creates opportunities for cross-selling and upselling. By understanding individual customer profiles, banks can recommend relevant products and services. For instance, a frequent traveler might be offered travel credit cards or insurance. Finally, hyper-personalization enables traditional banks to differentiate themselves in a crowded marketplace. Knowing clients on a highly individual level provides a competitive edge, particularly as digital-only and fintech competitors gain traction. Research reveals that banks employing hyper-personalization see up to a 15% increase in cross-selling and customer retention.

Overcoming Challenges in Hyper-Personalized Banking

Despite its advantages, hyper-personalized banking faces challenges. Data security is a primary concern, as storing vast amounts of customer data increases the risk of cyber incidents and breaches. Privacy concerns are also significant. While many customers appreciate the convenience of personalized services, some may feel uneasy about the level of access banks have to their personal information. Striking a balance between personalization and privacy is critical to earning and maintaining customer trust.

Implementing hyper-personalization requires substantial investment in technology and infrastructure, which can be a barrier for smaller banks. Additionally, adapting to a technology-driven system necessitates workforce retraining, as employees must develop new skills to operate effectively in an AI-enabled environment.

The Future of Banking: Hyper-Personalization and Digital Innovation

The financial industry is poised for further transformation through hyper-personalization. Advanced AI and data analytics tools will enable greater automation in financial consultation and investment advisory services. Digital-only banks and fintech firms are leading this evolution, compelling traditional banks to adapt and innovate to remain competitive.

As customer preferences shift, banks must integrate services across mobile apps and physical branches to deliver superior experiences. This approach could allow digital-only banks to target niche markets effectively while providing personalized, efficient services. The continued focus on innovation, data ethics, and regulatory compliance will shape the future of hyper-personalized banking.

Key Takeaways

- Hyper-personalization uses AI, machine learning, and data analytics to deliver customized financial solutions.

- Banks like JPMorgan Chase and BBVA demonstrate the impact of AI on customer engagement and revenue growth.

- Hyper-personalization enhances customer satisfaction, increases efficiency, and reduces costs through automation and targeted services.

- Challenges include data security, privacy concerns, technological investment, and workforce adaptation.

- The trend will reshape banking processes, emphasizing innovation, data ethics, and regulatory compliance.

#megatrends #hyperpersonalization #banking #digitaltransformation

FrankSchwab.de