Future-Proofing Prosperity: How Sovereign Wealth Funds Turn Megatrends into Strategic Advantage

Megatrends and the Strategic Imperative for Sovereign Wealth Funds

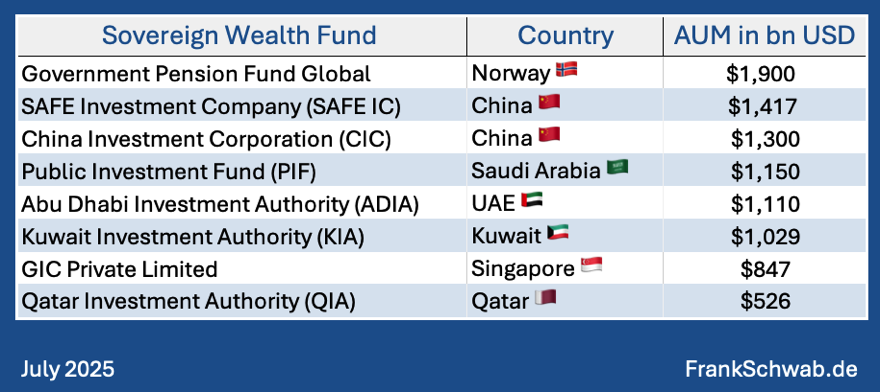

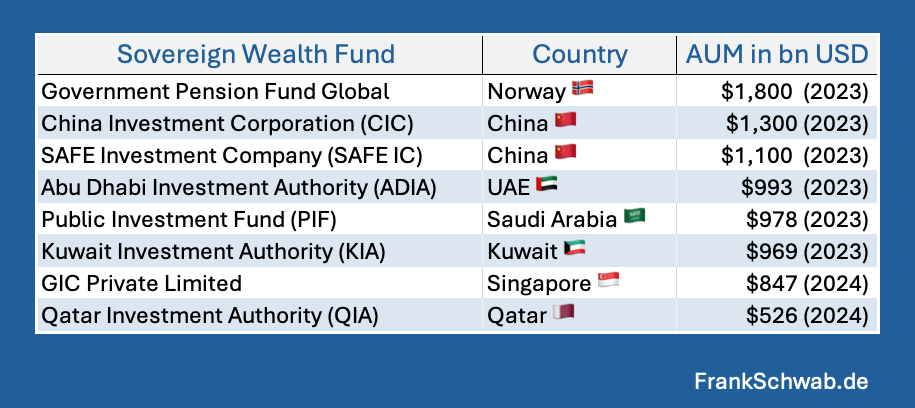

Megatrends are far-reaching, global patterns that fundamentally influence human behavior, mobility, and the environment, shaping the present and future. Sovereign Wealth Funds (SWFs) are state-owned investment vehicles managing substantial capital for governments, aiming for intergenerational equity and economic diversification. Growing from $1 trillion in 2005 to over $12 trillion by 2024, with approximately 80 funds globally, SWFs are major global capital market forces. Their long-term investment horizons and patient capital uniquely position them to align national wealth with the opportunities and challenges of these enduring global shifts.

Megatrends Defining the Future Investment Landscape

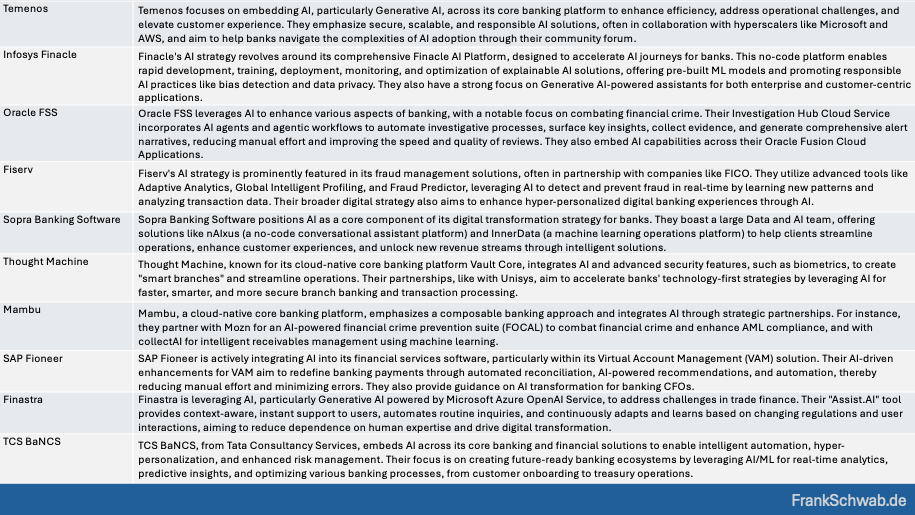

Key megatrends reshaping the investment landscape include climate change and sustainability, digital transformation (e.g., AI), demographic shifts (population growth, urbanization, aging), and resource scarcity. These trends present both significant risks and immense opportunities. For instance, climate change is seen as the greatest global risk but also the largest opportunity for positive change. AI integration across sectors like healthcare and finance is a prime example of technological impact. SWFs must proactively identify and capitalize on growth sectors emerging from these shifts.

Vision and Strategy - Aligning Capital with Global Shifts

SWFs, like Mubadala, integrate megatrend analysis into their investment strategies to deliver sustainable long-term returns. Their "institutional patience" is crucial for navigating market fluctuations and investing in themes evolving over decades. A significant strategic shift is the growing integration of Environmental, Social, and Governance (ESG) principles. A 2024 survey showed 68% of SWFs factor climate change into long-term investments, reflecting a recognition that sustainable practices are vital for long-term returns and risk management. Many SWFs also strategically diversify their economies away from volatile resource revenues.

Capitalizing on Emerging Opportunities

SWFs employ diverse asset allocation strategies, increasingly favoring alternatives and private markets like private equity, infrastructure, and private credit for diversification and higher returns. Direct investments in megatrend-impacted sectors are rising. From January 2023 to June 2024, SWFs engaged in 473 deals worth nearly $211 billion, primarily in finance, tech, energy, industrial/automotive, and healthcare. Examples include significant capital in energy transition (e.g., Mubadala's Masdar aiming for 100GW by 2030), digital infrastructure, AI supply chains, healthcare, and food/water management (e.g., Saudi's PIF in ACWA Power, $1.16 billion in food tech ventures 2019-2020). This shift involves building internal direct investing teams, reducing reliance on third-party managers. Despite short-term volatility, like the "Venture Capital Winter" (31 direct startup investments in 2023 vs. 133 in 2021), over 60% of SWFs maintained their long-term strategies, demonstrating resilience.

#SovereignWealthFunds #Megatrends #42megatrends

#SundayThoughts

FrankSchwab.de

Published in megatrends, SundayThoughts, all on 27.07.2025 7:24 Uhr.