8 Views on Bitcoin & Bitcoin ETFs

1️⃣ A New Era of Global Financial Integration Unfolds

By now, Bitcoin has established its presence in the world's most influential financial hubs, gaining recognition even from global banks and asset managers who were once critical.

2️⃣ Breaking Down Investment Barriers

The introduction of Bitcoin spot ETFs has simplified access to Bitcoin for investors previously constrained by regulatory limitations. Investors of all kinds can now participate in buying and selling, similar to traditional stocks, through regulated platforms.

3️⃣ Navigating the Price Structure of Bitcoin ETFs

While Bitcoin ETFs offer a convenient way to invest, there are additional costs involved, such as bank/brokerage custody fees, transaction costs, and spreads. This cost structure differs from holding one's own bitcoins, which incurs no management or custody fees.

4️⃣ #NotYourKeysNotYourCoins: The Vital Principle of Bitcoin Ownership and Security

The narrative #NotYourKeysNotYourCoins emphasizes the importance of maintaining control over one's Bitcoin. Bitcoin's core principles include decentralization, transparency, and resistance to censorship and manipulation.

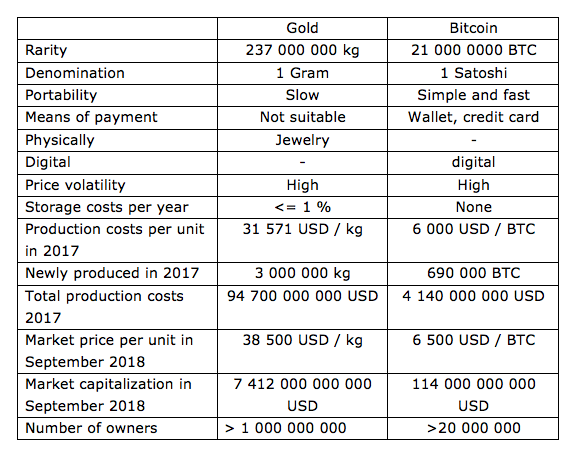

5️⃣ Bitcoin is More than Speculation

Bitcoin is positioned as more than just a speculative investment. It can be a valuable asset for people in countries with corrupt leaders, dictators, or fragile financial systems, offering a way to escape currency devaluation and exclusion from the traditional financial system.

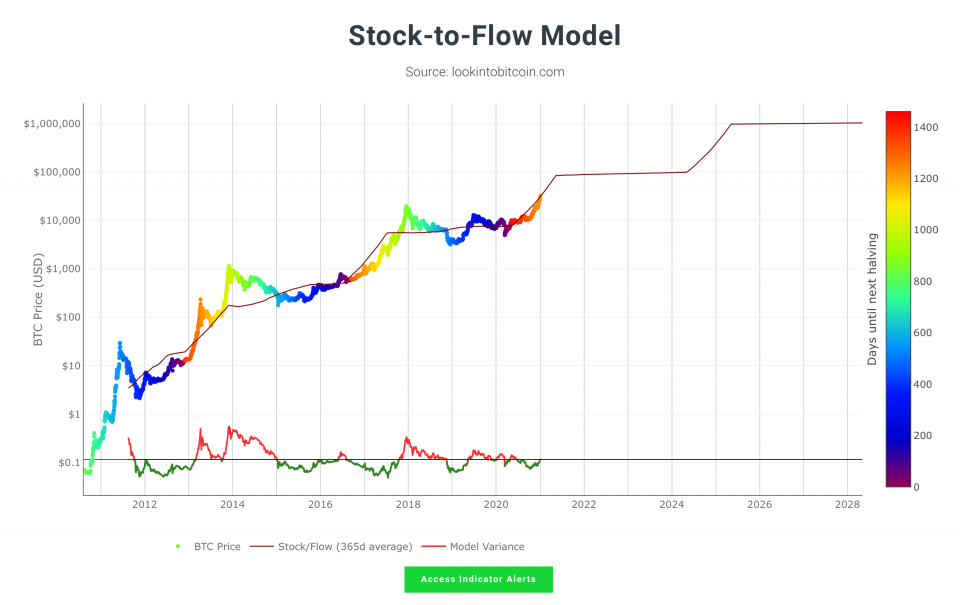

6️⃣ Inflation Resistance

Bitcoin's predictable nature as a form of currency without inflation sets it apart from traditional fiat systems. This characteristic gains significance when considering the substantial interest payments made by countries like the USA on their debt.

7️⃣ The Need for Custodial Diversity

Most Bitcoin ETF providers utilize Coinbase as a custodian. Fidelity stands out as the only provider operating with "self custody." Large investors seek diversification, not only in investment products but also in custodial practices.

8️⃣ Unraveling the Complex Factors Behind Bitcoin's Underperformance

Despite substantial capital influx into Bitcoin ETFs, the expected positive impact on Bitcoin's price hasn't materialized as quickly as anticipated. Factors like GBTC sales, low short-term demand for ETF-BTCs, and resistance from traditional financial players contribute to this underperformance.

Published in bitcoin, crypto on 27.01.2024 17:46 Uhr. 0 comments • Comment here