Sohar International Bank's Digital Transformation Journey

Customer expectations are changing. Driven by a demand for integrated, self-service options, banking customers are actively seeking solutions beyond traditional models. This shift has facilitated the rise of digital ecosystem banking, a collaborative approach where banks partner with other companies to provide a broader range of services.

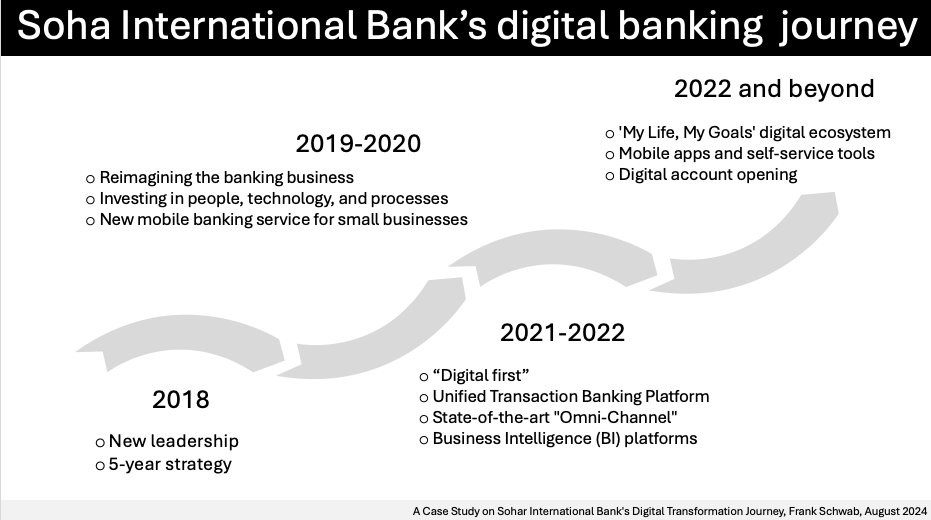

Sohar International Bank exemplifies how to navigate this digital shift. Sohar’s strategic transformation journey, initiated in 2018, prioritized customer experience through a five-year plan. This resulted in significant investments in people, technology and processes.

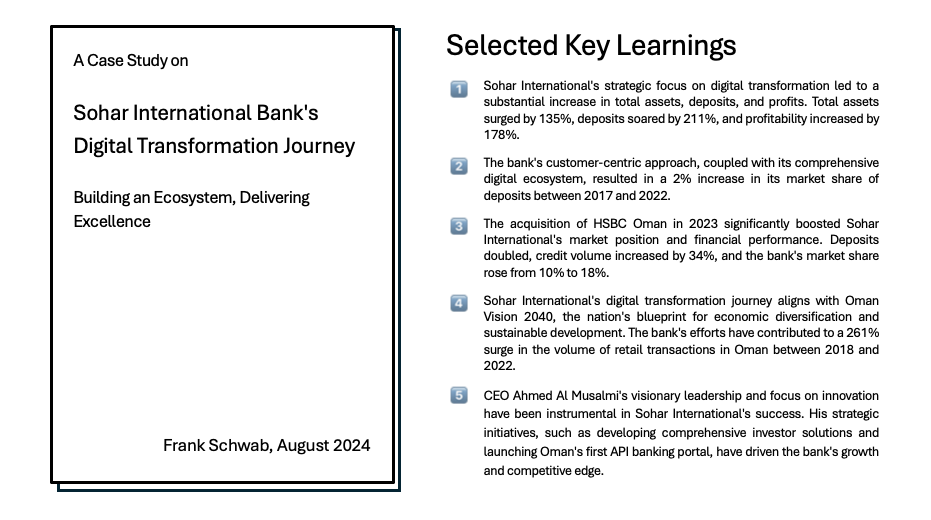

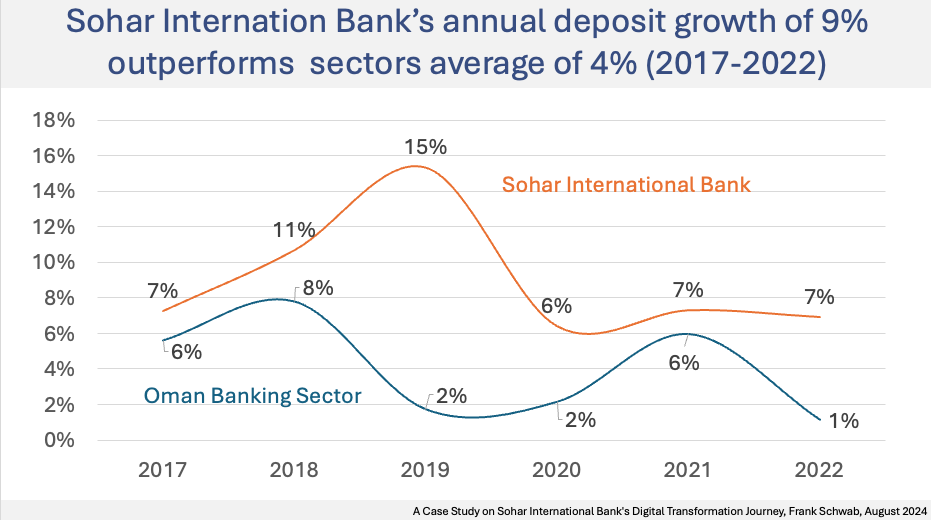

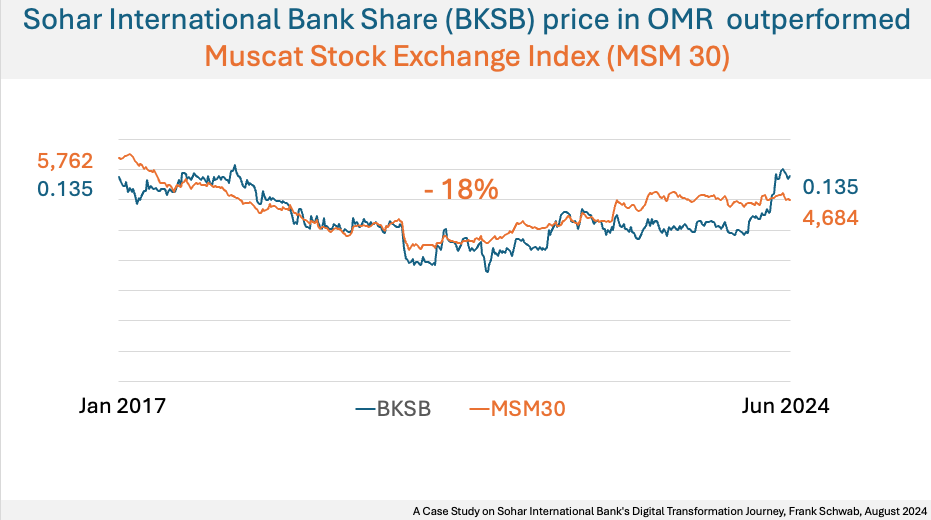

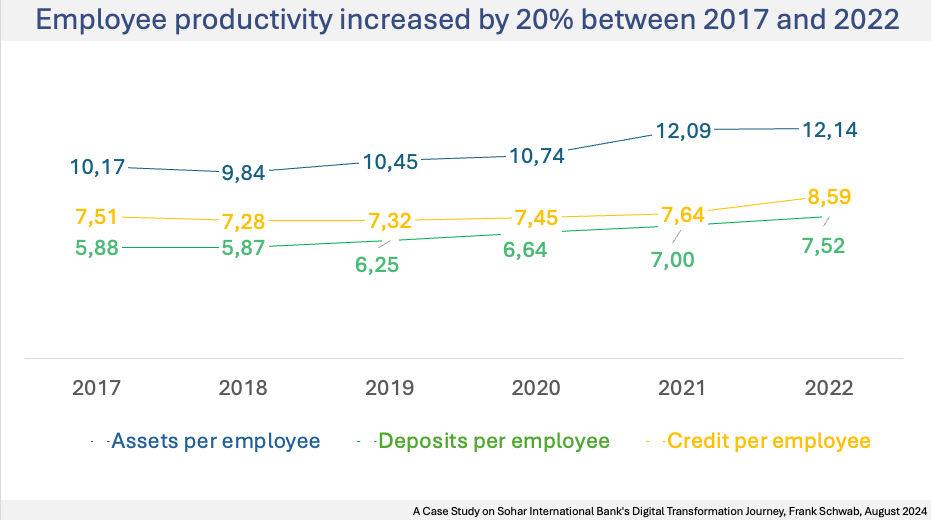

The outcome? A customer-centric mobile banking platform offering a comprehensive suite of financial and non-financial services, alongside a sophisticated transaction banking platform for businesses. A strong digital core, outperforming industry average returns, paved the way for long-term success. This foundation positioned the bank to seize a strategic M&A opportunity, acquiring HSBC Oman. Since the ownership changes in 2017 and development of new strategy in 2018, Sohar International's digital transformation journey has yielded significant results.

Built a World Class Ecosystem: The ecosystem has delivered seamless experience for Sohar International’s customers.

Market Expansion: Sohar International’s market share grew by 10% to 18%, with 2% organic growth and 8% inorganic growth through strategic acquisition of HSBC Oman.

Financial Growth: Total assets surged 135% to USD 10 billion, deposits soared 211% to USD 9 billion and profitability increased by 178% to USD 117 million.

Industry Recognition: Sohar International earned numerous prestigious awards like "Most Innovative Digital Bank for Ecosystem Services" and "Industry Leader in Digital Banking," highlighting the bank’s commitment to cutting-edge solutions.

Notably, Sohar International's commitment to digitalization aligns perfectly with Oman Vision 2040, the nation's economic development plan.

Sohar International Bank's acquisition of HSBC Oman presents a growth opportunity but also operational challenges, necessitating an efficiency program focused on leveraging digitalization and automation to streamline processes and optimize staff allocation. The program should prioritize integrating HSBC Oman's operations, consolidating systems, and upskilling employees for a digital environment, ultimately unlocking the acquisition's full potential. Additionally, the bank could explore strategic partnerships and acquisitions to expand its digital ecosystem, offering a wider range of financial products and services, and accelerating innovation through integrating new technologies and talent.

✍️ Contact me to learn more about the in-depth case study and receive the comprehensive 20+ page report, featuring detailed analysis and multiple informative graphs.

Published in CaseStudy, DigitalJourney on 25.07.2024 22:29 Uhr. 2 comments • Comment here