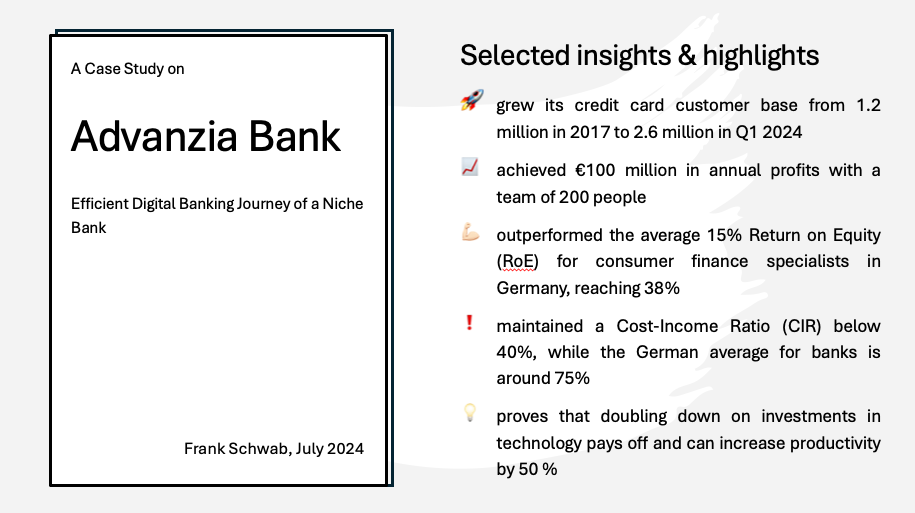

How 200 people achieve EUR 100 million in annual profits - Digital Banking Journey of Advanzia Bank

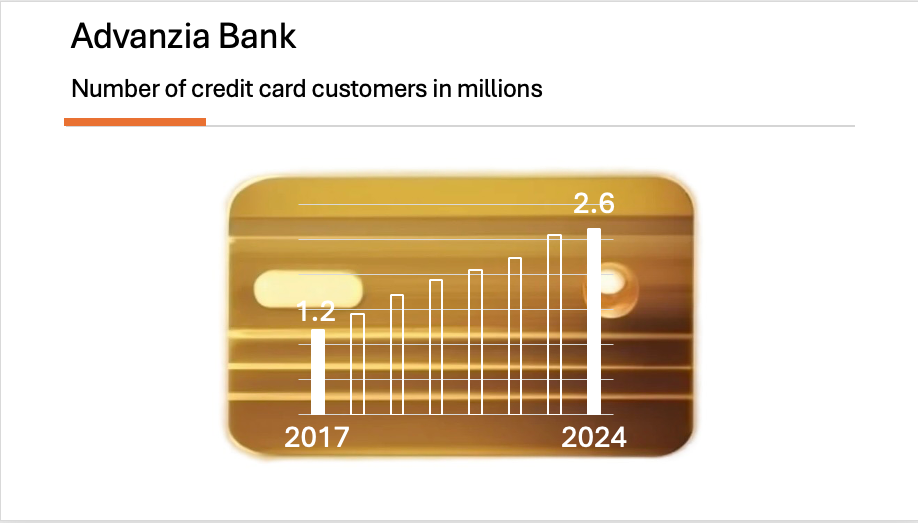

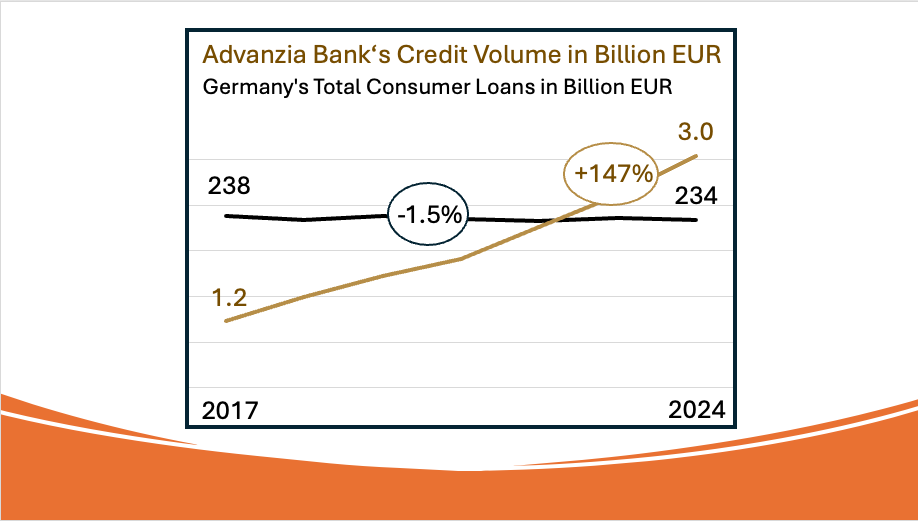

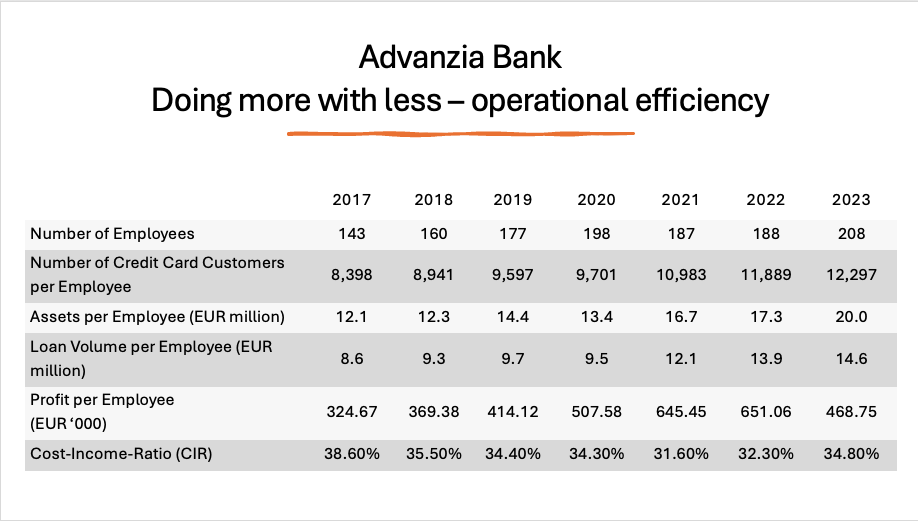

Advanzia Bank, a Luxembourg-based direct bank founded in 2005, has emerged as a digital banking trailblazer in the European market. It has achieved remarkable growth, expanding its credit card customer base from 1.2 million in 2017 to 2.6 million in Q1 2024. The bank's strategic focus on credit cards and payment solutions, coupled with its exclusive online and phone channel operations, has allowed it to maintain a lean team of 200 employees while achieving annual profits of EUR 100 million.

Financial Performance and Resilience

Advanzia's financial performance is noteworthy, boasting a Return on Equity (RoE) of 38%, surpassing the average of 15% for consumer finance specialists in Germany. The bank's Cost-Income Ratio (CIR) of less than 40% is also significantly lower than the German banking average of 75%. Despite economic challenges in 2023, including rising funding costs and an increase in non-performing loans, Advanzia's long-term performance remains strong.

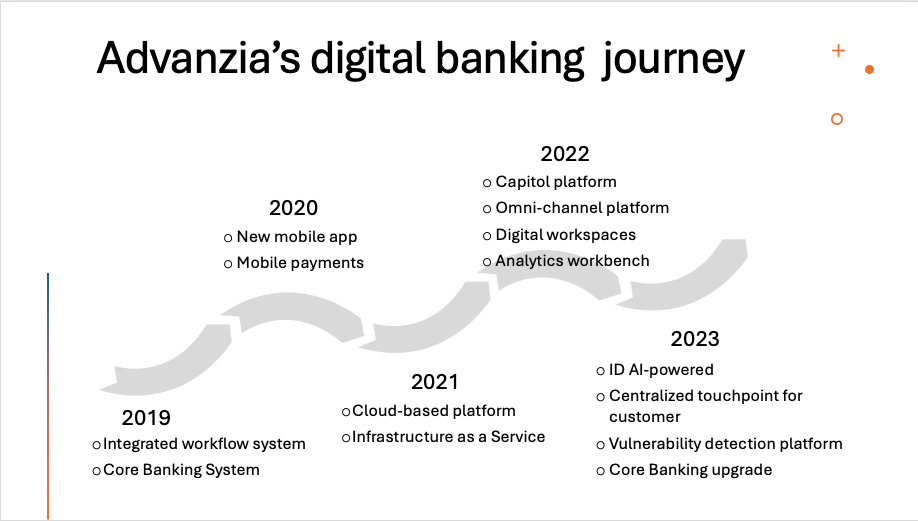

Digital Transformation and Innovation

Advanzia's commitment to digitalization is evident in its investments in software and technology. Key milestones include implementing AI-powered fraud detection, launching new mobile apps, and completing a full digital migration to the cloud. These investments have streamlined processes, enhanced customer service, and improved operational efficiency.

Customer-Centricity and Strategic Partnerships

Advanzia's success is attributed to its customer-centric approach, agility, data-driven decision-making, and strategic partnerships. The bank's free Mastercard Gold credit card, with no annual fee, has been a major draw for cost-conscious consumers. Advanzia's total turnover on all cards reached EUR 6.3 billion in 2023, with an average loan balance of EUR 1,700 per active customer.

Future Growth Strategies

Advanzia's future growth strategy may involve a combination of organic growth through creative digital marketing and inorganic growth through specialized mergers and acquisitions. The bank's focus on community building, data-driven personalization, gamification, and innovative marketing could attract new customers and foster loyalty. Additionally, Advanzia could explore acquiring smaller financial institutions specializing in niche markets to expand its portfolio and market share.

✍️ Contact me to learn more about the in-depth case study and receive the comprehensive 18+ page report, featuring detailed analysis and multiple informative graphs.

Published in CaseStudy, DigitalTransformation, DigitalJourney on 29.06.2024 20:37 Uhr. 1 comment • Comment here