Banks struggle to balance modernization with the limitations of legacy systems. While no single approach dominates, considerations like a bank's size, goals, and risk tolerance will shape their transformation strategy. Success hinges on not just technology, but also effective change management and adaptability within the organization.

Banks today face a critical challenge: how to evolve and thrive in a rapidly digitizing landscape while grappling with the inertia of their often aging, complex legacy systems.

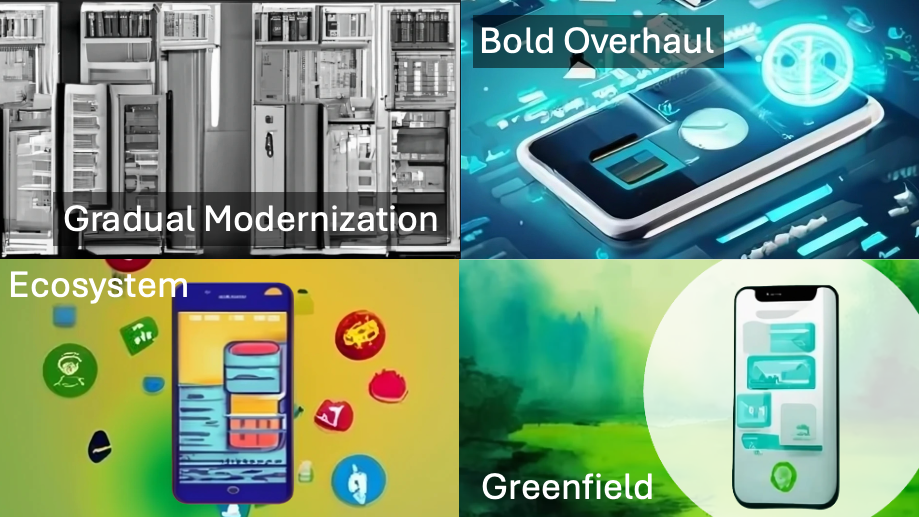

In a recent LinkedIn poll, I asked my community about the best approaches for banks to handle legacy technologies. While none of the three options (gradual modernization, complete overhaul, or ecosystem integration) emerged as a clear favorite, there was a general dislike for the idea of a complete overhaul. This article reflects the valuable insights shared by several contributors, with special thanks to Ewan MacLeod for suggesting the Greenfield Approach.

Charting the Course: Considerations for a Successful Transformation

The optimal approach for each bank depends on a unique blend of factors, including size, risk appetite, budget, strategic goals, and the complexity of their legacy system. Careful consideration of the benefits, challenges, and pitfalls presented by each approach is crucial for informed decision-making. While gradual modernization might suit larger banks prioritizing stability, smaller, more agile players might favor greenfield development. Ecosystem integration offers a collaborative avenue, but complete overhauls require meticulous planning and significant resources.

Let’s have a look at the 4 approaches

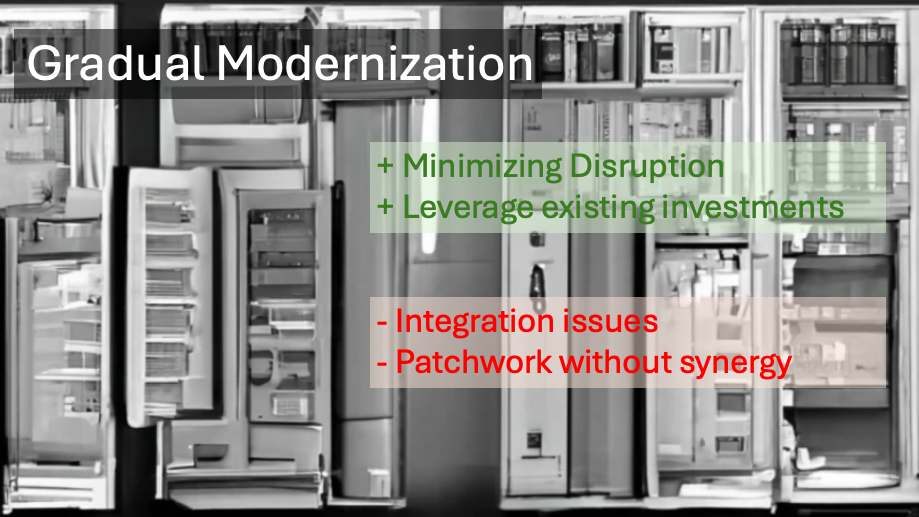

1️⃣ Gradual Modernization - Minimizing Disruption with Measured Steps

The gradual modernization approach prioritizes a measured climb, tackling key areas like customer-facing applications or core processes in stages. This strategy offers the advantage of minimizing disruption to ongoing operations and the customer experience. It leverages existing investments in legacy systems, allowing for targeted improvements in areas with demonstrably high impact. However, this measured approach can be a slow and piecemeal process, potentially hindering overall effectiveness. Integration issues may arise between new and old systems, and perpetuating outdated functionalities can hinder the adoption of truly innovative solutions. The pitfalls of this approach lie in a lack of a clear long-term vision, leading to a patchwork of solutions without synergy, and delaying crucial upgrades, which can render the bank less competitive in the long run.

Many incumbent banks are following the path of gradual modernization, such as Deutsche Bank, Barclays Bank, or Citibank.

2️⃣ Bold Overhaul - Embracing a Future Unburdened by the Past

The complete overhaul approach takes a more audacious path, aiming for a clean slate by replacing the entire technology stack with modern, integrated systems. This bold move unlocks several benefits, including fostering agility, scalability, and future-proof technology. Streamlined operations and potential long-term cost reductions are alluring prospects. However, this disruptive and resource-intensive process carries significant implementation risks, with high upfront costs and the potential for delays and budget overruns. The loss of institutional knowledge and expertise embedded in legacy systems also presents a challenge. Poor planning and execution can lead to chaos and operational downtime, while neglecting employee training and change management can breed resistance and hamper adoption.

Some incumbent banks, such as the Commonwealth Bank of Australia, are known for successful bold overhauls, albeit at very high costs, while others, like Deutsche Bank, didn’t succeed.

3️⃣ Collaboration for Innovation: Harnessing the Power of the Ecosystem

Instead of a complete overhaul, the ecosystem integration approach focuses on weaving legacy systems into a broader digital tapestry. This strategy leverages the expertise and innovative solutions of fintech partners, enabling faster time-to-market for new features and functionalities. It allows banks to utilize their existing legacy systems while adding modern capabilities. However, finding compatible partners with secure and reliable solutions is crucial. Managing data security and privacy concerns when integrating with external systems presents another challenge. Potential vendor lock-in and dependence on external partners must also be carefully considered. This approach can stumble if clear governance and collaboration frameworks are not established, leading to confusion and inefficiencies. Overreliance on external solutions can weaken internal development capabilities.

Spanish BBVA and Singaporean DBS are well-known banks pursuing an ecosystem strategy.

BBVA is recognized as a pioneer in open banking and boasts a successful ecosystem approach. Their robust API platform has spurred numerous fintech partnerships, fostering innovation in their customer offerings. While specifics may evolve, BBVA's commitment to collaboration positions them as a driving force in shaping the future of finance.

DBS boasts one of the most comprehensive and accessible API platforms in the banking industry, with over 200 APIs spanning various financial services. Their dedicated focus on collaboration and developer enablement has made them a leader in open banking, particularly within the Asia-Pacific region.

4️⃣ Building a Greenfield Bank: Unburdened by History, Empowered by the Future

The greenfield development approach takes the most radical path, starting from scratch to build a new technology infrastructure, free from the constraints of legacy systems. This offers unparalleled flexibility and scalability, allowing banks to design systems tailored to their specific needs. It fosters a culture of innovation and agility from the ground up. However, this significant undertaking requires substantial upfront investments and carries the risk of abandoning past investments. Banks may lack the institutional knowledge and expertise needed to build and maintain complex systems, and this approach often carries a longer implementation timeframe compared to others. Ignoring lessons learned from legacy systems can lead to repeating past mistakes, and underestimating the complexity of building and integrating entirely new systems from scratch is a significant pitfall.

When I consider examples like Revolut, Starling, J.P. Morgan's Marcus, Commerzbank's ComDirect, or Deutsche Bank's Bank 24, among others, my takeaway is this: a Greenfield approach works well for startups, but there's no track record for incumbents.

Beyond Technology: The Human Factor in Transformation

It is vital to remember that transformation is not solely about technology. Effective change management, cultural shifts, and employee training are essential for the successful adoption of any approach. By addressing these human factors alongside the technological considerations, banks can ensure a smooth and successful journey towards a future-proofed financial institution.

A Dynamic Journey

Transforming a bank with legacy technology is a complex and multifaceted endeavor. Each approach offers unique advantages and drawbacks, and the ideal path depends on individual circumstances. By carefully considering their specific needs and resources, banks can navigate the maze of transformation and emerge as agile, future-proof institutions in the ever-evolving financial landscape. Remember, the journey is dynamic, and continuous evaluation and adaptation are crucial for navigating the twists and turns towards a successful future.