Mauritius Commercial Bank’s Digital Transformation Journey - Leading the way with technology, efficiency, and customer focus

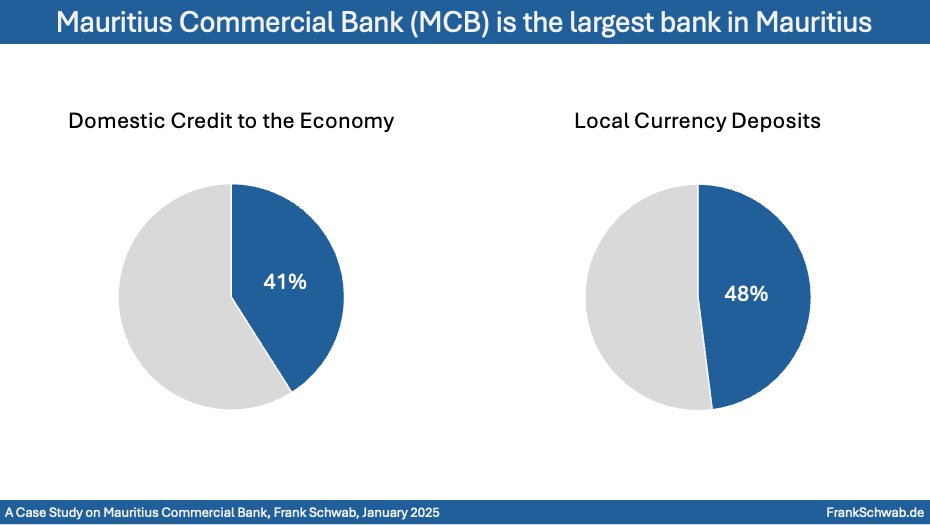

The Mauritius Commercial Bank (MCB) has undergone a significant digital transformation that has positioned it as a leading financial institution both in Mauritius and the region. MCB's market share in domestic credit and deposits stands at 41% and 48%, respectively.

Established in 1838, MCB is the largest bank in Mauritius, with a balance sheet size of USD 18.4 billion as of 2024 and net profits of USD 330 million.

Its strategic focus on digital channels has led to 85% of retail transactions being processed online, with its mobile app, "MCB Juice," boasting over 500,000 users.

MCB's operations span internationally, contributing 63% of its profits in 2023, with expansions into markets like Madagascar, Mozambique, and India. The bank's robust digital infrastructure includes the adoption of Oracle Exadata, reducing batch processing times by 64% and cutting database patching durations by 99%.

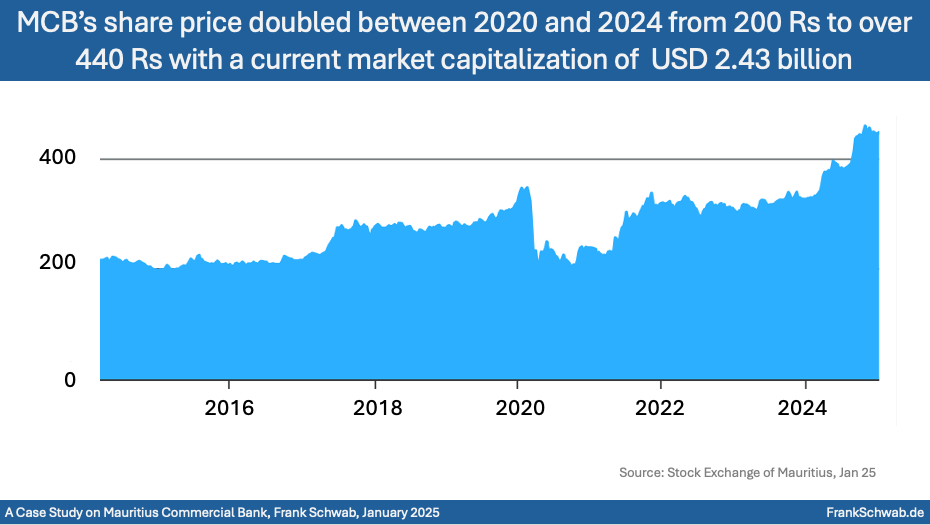

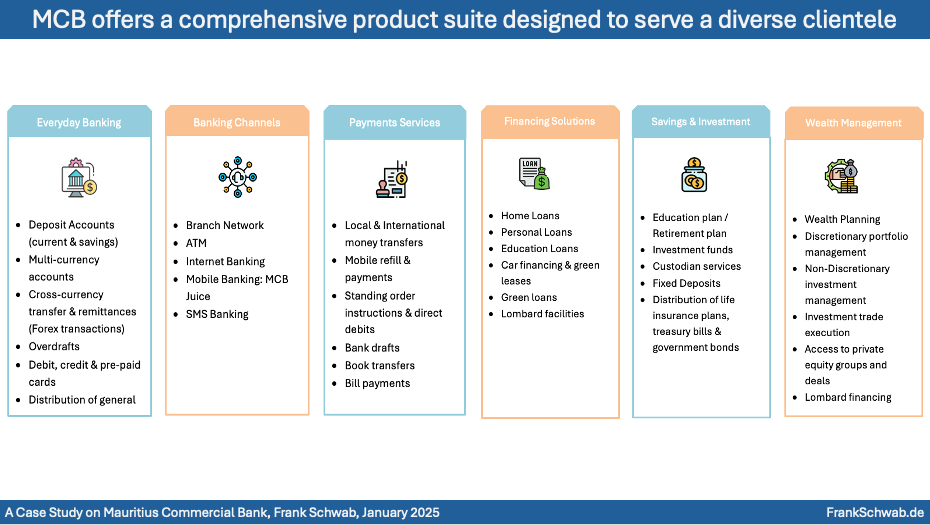

MCB has diversified its offerings, providing products such as green loans for sustainable projects and SME-targeted solutions like JuicePro. MCB’s loan portfolio has grown at a CAGR of 13% from 2017 to 2024, while customer deposits increased by 12.37% annually over the same period. A capital adequacy ratio of 19.8% and a NPL ratio of 2.8% underline its financial stability. Innovations like SmartApprove have streamlined corporate transactions, achieving a 90% straight-through processing rate, while partnerships with firms such as Backbase and Mobiquity have enhanced customer experience across segments.

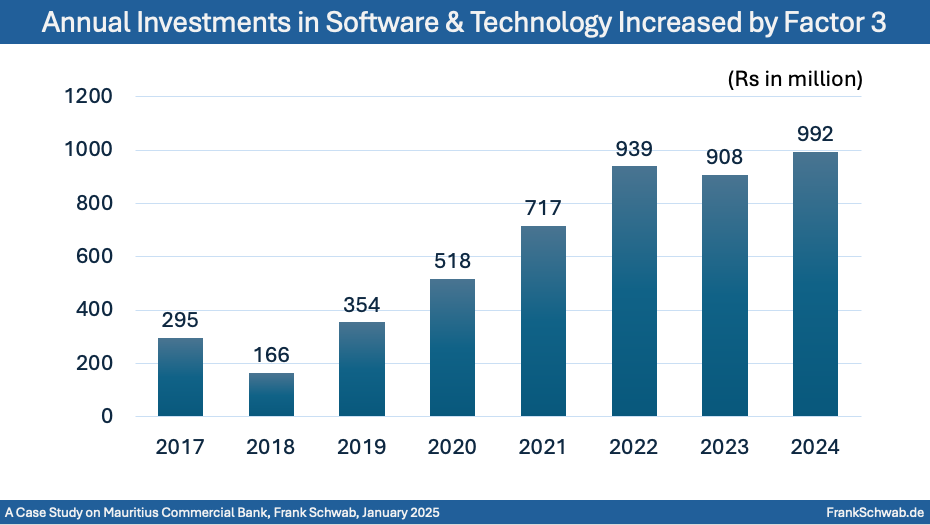

The bank has invested over USD 100 million in software and technology since 2017.

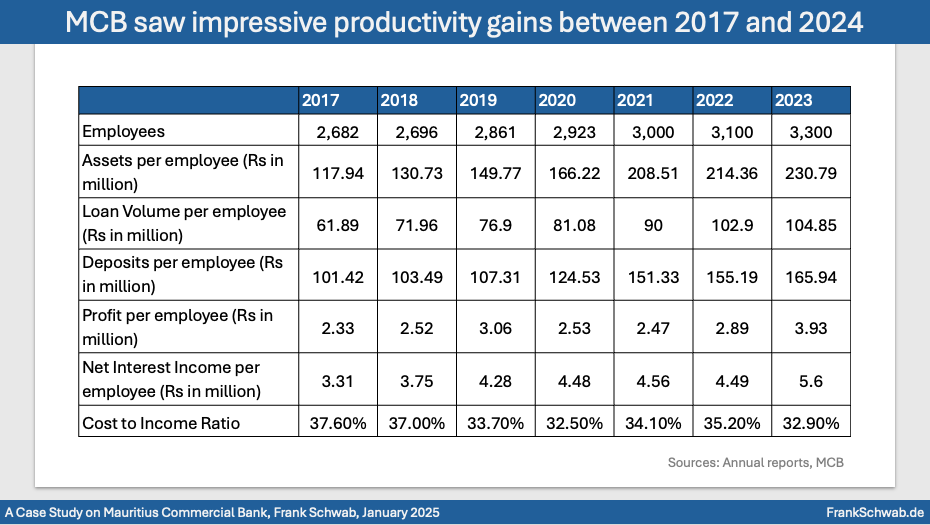

MCB has expanded its employee base to 3,300, maintaining a high retention rate of 96%. Its operational efficiency is demonstrated by a Cost-to-Income Ratio (CIR) improvement to 33.6% in 2024.

The implementation of AI and predictive analytics in credit scoring has strengthened risk management, while digital lending reduced loan approval times to as low as four days for personal loans.

Customer-centric initiatives, including Juice Invest for wealth management, have enhanced user engagement, with over 29,000 active portfolios by late 2023. The integration of Windward's AI-powered compliance tools has streamlined maritime trade finance, while the Punch marketplace supports over 3,000 SMEs.

As MCB continues to leverage technology and partnerships, it sets a benchmark for innovation and resilience in the banking industry.

✍️ Contact me to learn more about the in-depth case study and receive the comprehensive 40 pages report, featuring detailed analysis and multiple informative graphs.

http://www.FrankSchwab.de

#banking #strategy #digital #digtialtransformation #digitaljourney

Published in CaseStudies, all on 07.01.2025 8:30 Uhr.