The four seasons of cryptocurrencies

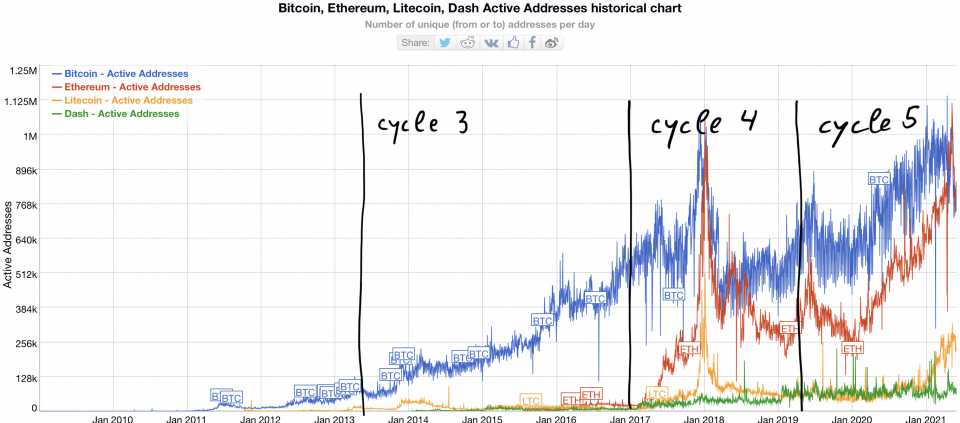

It's that time again. In the past few days and weeks, reports about the end of Bitcoin and cryptocurrencies have increased. - Now for the fifth time - after June 2011 (cycle 1), April 2013 (cycle 2), December 2013 (cycle 3) and January 2018 (cycle 4).

The following perspectives and thoughts on the past two cycles (3 and 4) and the current fifth cycle:

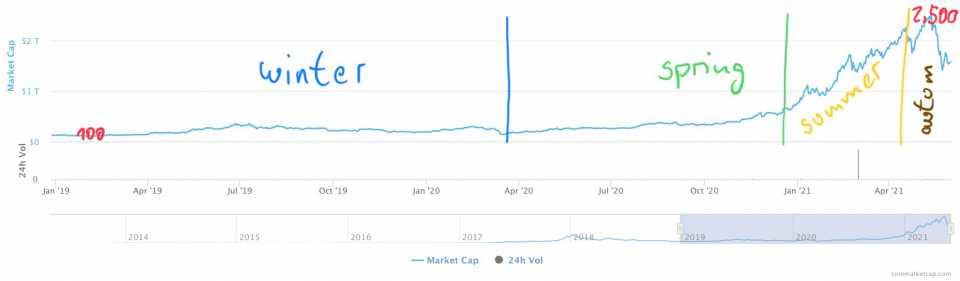

Obviously, the course of the market capitalization of the fledgling cryptocurrency and blockchain industry repeats itself. Since the media repeatedly talk about the crypto winter, I ask myself several questions:

- Are there also the crypto seasons spring, summer and autumn?

- If so, how do they differ and how long do they last?

One try. What can be observed:

- The six-month crypto spring May to Oct 2013 showed a stable market capitalization of USD 2.5 billion

- In the only two-month crypto summer Oct / Nov 2013, the market capitalization quadrupled from USD 2.5 billion to more than USD 10 billion

- In the two-month crypto fall Dec 2013 / Jan 2014, market capitalization peaked at USD 15 billion, which was six times the crypto spring.

- The market capitalization of USD 5 billion in the following almost two-year crypto winter 2014/2015 fell to a third of the high of USD 15 billion in the crypto autumn 2013/2014

- The market capitalization in the crypto winter 2014/2015 was at least USD 5 billion, roughly twice as high as the market capitalization in the crypto spring 2013.

- In December 2015, market capitalization was back to just under USD 7 billion.

Cycle 4 - 2.25 years from Jan 2017 to March 2019

- As part of the fourth cycle, a four-month spring can be observed. The 4th spring started with a market capitalization of more than USD 17 billion in Jan 2017 and in May 2017 it already had a fivefold increase in market capitalization with more than USD 90 billion.

- The six-month summer that followed drove market capitalization as high as USD 650 billion from June 2017 to Dec 2017

- And at the beginning of the crypto fall (Jan-May 2018) of the 4th cycle, the market capitalization reached more than USD 800 billion in Jan 2018.

- This was followed by another, now the fourth, crypto winter, which started in June 2018 and after about eight months in Jan 2019 saw market capitalization shrink to USD 100 billion, 1/8 of the high a year earlier.

- Despite this decline, even in the crypto winter of the fourth cycle, market capitalization remained constant above USD 100 billion and thus well above the market capitalization of spring

Cycle 5 - April 2020 to today

- We are now in the 5th cycle, which started around April 2020 with a market capitalization of USD 180 billion.

- In the nine-month spring (April to Dec 2020), a market capitalization of over USD 500 was already achieved in Dec 2020

- The summer of the fifth cycle can be estimated over a four-month period from Jan to April 2021. At the end of the summer, market capitalization topped USD 2,200 billion for the first time.

- And in May 2021, market capitalization hit its preliminary high of more than USD 2,500 billion.

- Since May 2021 we have been in the autumn of the fifth cycle from my point of view.

- A decline in market capitalization to USD 1,500 billion in May / June 2021 suggests that the fifth crypto winter is imminent

Outlook

Following the last two cycles, one would now expect a fifth crypto winter lasting many months with a minimum market capitalization of USD 200 billion.

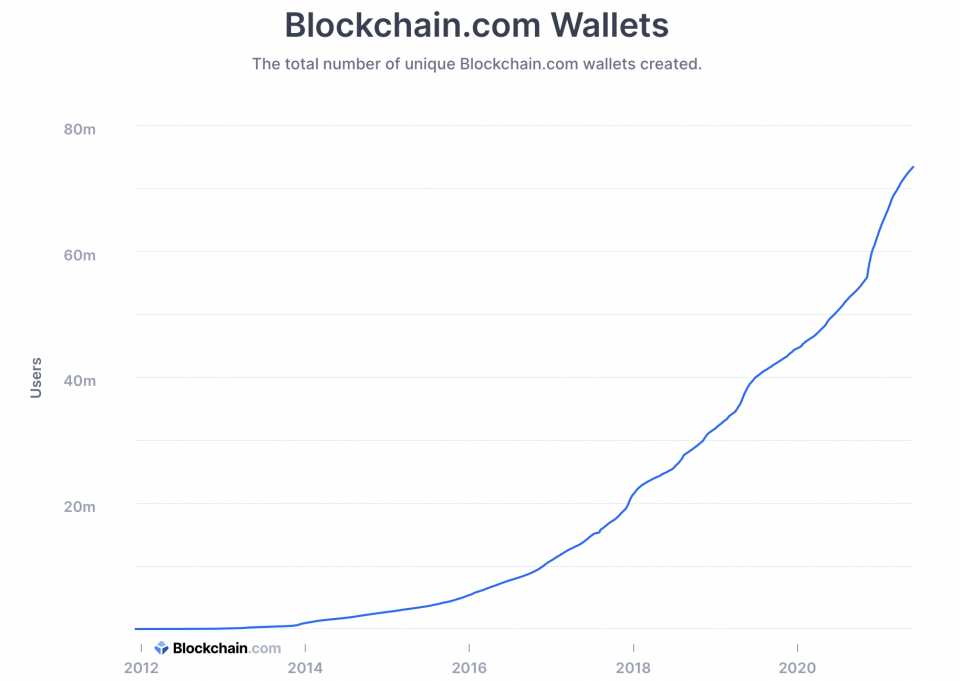

But the upcoming crypto winter 2021 could be short-lived this time, because many framework conditions have developed significantly in the last few cycles and the next generation of private and commercial users is in the starting blocks. The maturity level of crypto projects, products, coins and tokens is also increasingly broader and deeper.

The global, financial framework conditions also show signs of change. Whether new FinTech attackers, large platforms or the unbelievably large amounts of new money from the central banks in recent months - traditional banks, financial service providers and FIAT currencies are in a state of upheaval, not least due to negative interest rates and expected inflation.

This opens up the opportunity for cryptocurrencies to establish themselves as digital currencies for a digitized world.

And the steadily increasing wallet and transaction numbers support this thinking.

Published in crypto, cryptocurrency, The-four-seasons-of-cryptocurrencies on 07.06.2021 12:42 Uhr. 0 comments • Comment here