Navigating the Jungle of Strategy Meetings - Taming Zebras, Wolfs, Hippos, and Rhinos

When seeking to understand the key reasons for the failure of strategy implementations, one can pinpoint recurring themes such as ‚inability to manage change,' 'conflicts with established power structures,' 'encountering cultural resistance,' and 'ineffective communication.' Consequently, achieving success in your business transformation efforts greatly relies on your ability to comprehend and navigate the individuals and dynamics you will encounter.

Let's examine a specific component: strategy meetings. Strategy meetings play a crucial role in helping organizations achieve their objectives and propel their implementation efforts forward. However, these meetings can sometimes encounter disruptions in the form of Zebras, Wolfs, Hippos, and Rhinos - colorful metaphors for challenging personalities that can negatively impact the decision-making process.

Let’s have a look at the characters first:

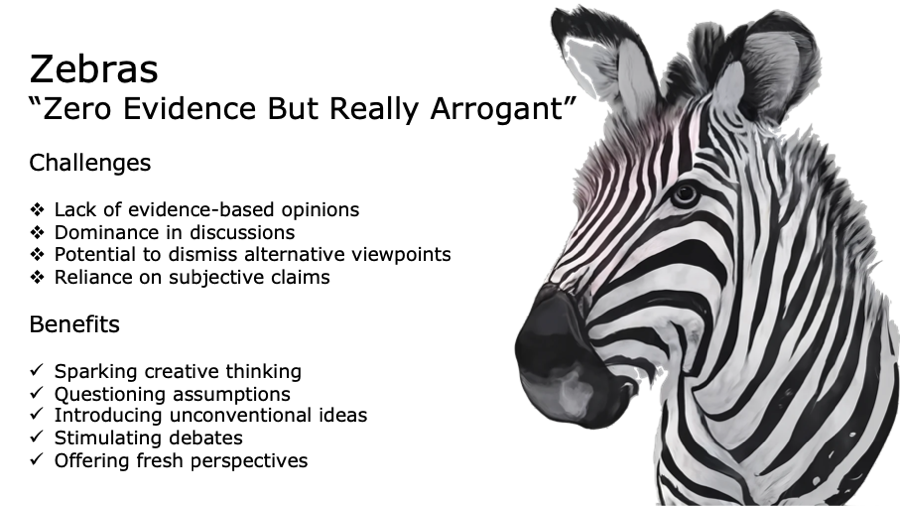

The ZEBRAs “Zero Evidence But Really Arrogant”

Zebras, often hailed for their confidence, can unwittingly sabotage strategy meetings. Their penchant for asserting opinions without factual evidence can derail discussions and lead to decisions grounded in subjective views rather than objective data. Their arrogance may stifle alternative viewpoints, creating an echo chamber of ideas.

The WOLFs “Works on Latest Fire”

Wolfs thrive on tackling the latest fires, often at the expense of long-term strategic discussions. Their ability to focus on immediate concerns can divert the meeting's attention and impede progress toward long-term goals.

The Hippo “Highest Paid Person's Opinion”

Hippos, often revered due to their position, can unintentionally cast a shadow over other voices in strategy meetings. Their opinions, given undue weight, might suppress diverse perspectives and discourage open dialogue.

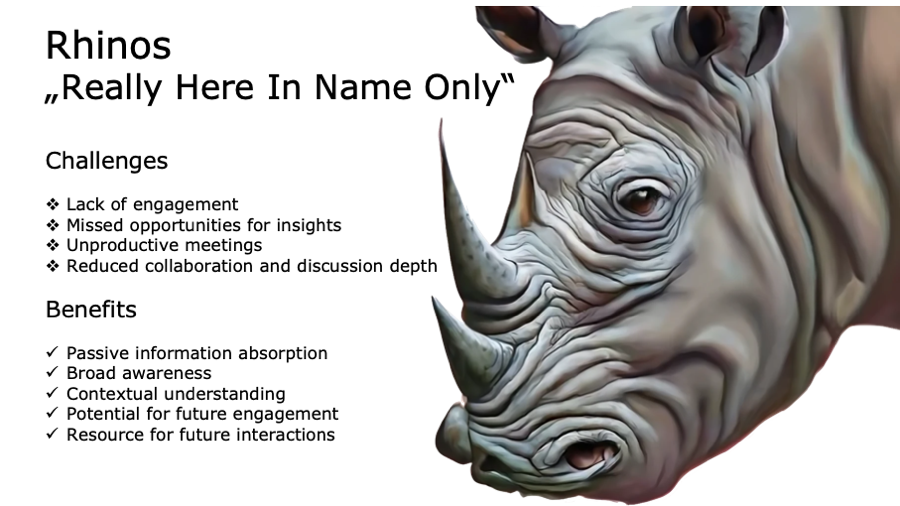

The Rhino “Really Here In Name Only”

Rhinos, while physically present, may lack active engagement, leading to unproductive meetings. Their passive presence can hinder meaningful discussions and lead to missed insights.

It is not about getting rid of the wild animals - it is about taming them

While Zebras, Wolfs, Hippos, and Rhinos are wild animals they also come with benefits. A Zebra may have innovative ideas and a diverse perspective that stimulates the strategic discussion. The wolf is able to address urgent matters swiftly and effectively and has skills in crisis management and quick problem-solving which can be valuable in certain strategic situations. And a hippo can bring to the table their ability to provide strategic direction, guidance, and decision-making based on their experience, expertise, and authority within the organization. And the main benefit of a rhino is their potential for passive observation and awareness. Their presence allows them to absorb information, gain insights into ongoing discussions, and stay informed about the organization's direction and decisions.

The influence of Zebras, Wolfs, Hippos, and Rhinos can undermine the efficacy of these meetings, leading to suboptimal outcomes. However, by adopting counter measurements, organizations can navigate these challenges successfully. That raises the question, how to tame them best.

Facts & figures are king to tame zebras

The best way to encounter zebras is by encouraging a data-driven approach, where opinions are backed by solid evidence. It is recommended to gently challenge Zebras to present substantiated facts supporting their claims. Or you can provide alternative viewpoints supported by data, showcasing the importance of a balanced discussion to tame Zebras. And it is helpful to lead by example by presenting your own arguments with well-researched facts and figures.

Allocate time, delegate responsibility, align with strategy and balance the discussion when dealing with wolfs

To tame wolfs it is recommended to allocate specific time slots for addressing urgent matters in order to maintain a balance between short-term and long-term discussions. And you can assign someone to handle immediate issues outside the meeting and provide a summary during discussions. A further measurement to tame wolfs is to emphasize how addressing urgent matters aligns with the organization's overarching strategy. It is also recommended to strive for equilibrium between addressing immediate concerns and discussing long-term objectives.

Foster an inclusive culture, emphasize data, ask for equal input and challenge hippos respectfully

It is important when dealing with hippos to foster an inclusive culture where all participants feel valued and encouraged to share their insights. You also should encourage data-backed opinions, demonstrating the importance of evidence in decision-making. A proven method to tame hippos is to create opportunities for input from all team members to ensure a comprehensive view of the situation. It is also helpful to politely challenge hippos' opinions and present alternative viewpoints supported by data.

Set clear expectations, create opportunities for input, assign follow-up tasks and establish feedback loops to awakening rhinos participation

A measurement to encourage rhinos participation is to communicate the purpose and role of all participants to set clear expectations. You may designate specific moments for Rhinos to share insights or ask questions during discussions. It is recommended to assign follow-up tasks related to meeting discussions to encourage engagement beyond the meeting. You may also gather feedback from Rhinos to make improvements and enhance their participation.

A structured agenda, a facilitator role, data-driven culture, diverse participation and an inclusive environment are overarching strategies to make best out of your strategy meetings

To effectively manage all types of participants consider implementing the following overarching strategies:

1. Have a well-structured meeting agenda that includes dedicated time for urgent matters, strategic discussions, and input from all team members.

2. Assign a skilled facilitator to guide discussions, manage contributions, and ensure everyone's voice is heard.

3. Cultivate a culture of evidence-based decision-making where opinions are supported by data and facts.

4. Invite a diverse group of participants to ensure a variety of perspectives and insights are considered.

5. Create a safe and inclusive environment where all participants feel comfortable sharing their thoughts, regardless of their rank or role.

By proactively addressing the challenges posed by Zebras, Wolfs, Hippos, and Rhinos, you can promote effective, balanced, and productive strategy meetings that lead to well-informed decisions and successful outcomes.

Published in strategy, transformation, digital, meeting, zebra, wolf, hippo, rhino, Navigating-the-Jungle-of-Strategy-Meetings on 04.10.2023 17:15 Uhr. 0 comments • Comment here