The Shifting Landscape of Ownership: Understanding Traditional vs. Tokenized Shares

As reported a few weeks ago, I am the proud owner of the first tokenized shares issued by NYALA Digital Asset AG to its shareholders. Since then, many people have asked me about the differences between traditional and tokenized shares. Here is my assessment, and I would like to extend my thanks to Johannes Schmitt for his input and feedback.

For centuries, the stock market has served as the gateway to corporate ownership, connecting investors to companies and fostering economic growth. Yet, the advent of blockchain technology has thrown open the doors to a new frontier: tokenized shares. These digital representations of ownership promise a paradigm shift, but how do they stack up against their traditional counterparts? To navigate this evolving landscape, it's crucial to grasp the key differences between these two modes of share ownership.

I) Beneath the Surface: The Underlying Asset

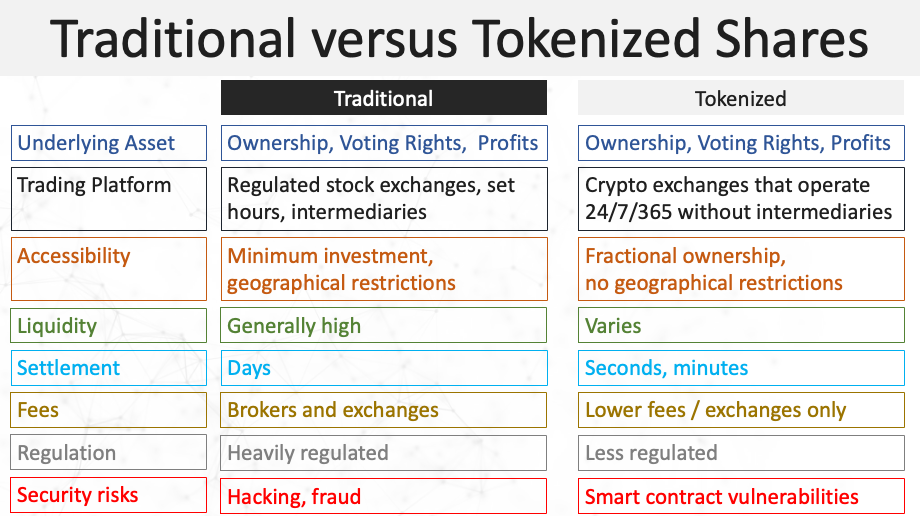

The foundation of any share is the underlying asset it represents. Traditional stocks offer a clear-cut claim: ownership in a company, complete with voting rights and a share of profits. Tokenized shares, however, can be more diverse. While some equity tokens directly mirror traditional stocks, others, like asset-backed tokens, might tie your investment to real estate or commodities. Still others, known as utility tokens, simply grant access to products or services, distinct from ownership itself. Understanding the nature of the underlying asset becomes paramount when navigating the tokenized world.

It is also conceivable for the near future that holders of tokenized shares, in need of short-term cash, can deposit their shares into a regulated version of MakerDAO, a decentralized lending platform, in addition to their digital identity, in order to obtain a loan that is instantly disbursed without further credit checks. And all of this, within a few minutes. Such use cases are only made possible through the tokenization of shares on a public blockchain, as this technology enables fast, flexible, and transparent lending.

II) Trading Platforms: From Brick-and-Mortar to 24/7 Markets

Traditionally, stock exchanges have served as the physical battlegrounds for buying and selling shares. With their set hours and reliance on intermediaries like brokers, these platforms provide a well-established, albeit sometimes sluggish, system. Tokenized shares, however, operate on decentralized exchanges, leveraging blockchain technology to offer 24/7 accessibility and a potentially faster, peer-to-peer trading experience. This eliminates the need for intermediaries, but introduces a different set of complexities and requires greater technological understanding.

III) Opening the Doors: Accessibility and Fractional Ownership

One of the biggest barriers to traditional stock ownership is the often-significant minimum investment amount. Tokenization breaks down this barrier by enabling fractional ownership, allowing investors to participate in larger assets with smaller amounts. This democratizes access to investments previously out of reach, potentially fostering broader participation in the market. However, the liquidity and regulatory landscape in the tokenized world can still be less developed compared to traditional markets, adding a layer of risk for the less experienced investor.

IV) Liquidity: Finding Buyers Matters

Liquidity, or the ease with which an asset can be bought and sold, is crucial for investors seeking to exit their positions. Traditional stocks, especially those of established companies, often boast high liquidity, meaning buyers and sellers are readily available. Tokenized shares, however, can exhibit varying levels of liquidity depending on the specific token and platform. Less popular tokens may present challenges when it comes to finding buyers, potentially impacting your ability to cash out your investment.

V) From Days to Seconds: The Speed of Settlement

When it comes to settling trades, the difference between traditional and tokenized shares is stark. While traditional systems can take days to finalize, blockchain-based platforms offer near-instantaneous settlement, potentially allowing for quicker access to your investment proceeds. This speed comes at a cost, however, as the underlying technology and regulatory frameworks for tokenized shares are still evolving, introducing potential new risks and uncertainties.

VI) Fees and Friction: Balancing Cost and Efficiency

Transaction fees are an inevitable part of any investment. Traditional systems involve various players, each taking a cut, which translates to higher fees for investors. Tokenized platforms, on the other hand, often boast lower fees due to their streamlined, peer-to-peer nature. However, it's crucial to factor in the potential volatility and lack of standardization in fees within the tokenized space.

VII) Navigating the Maze: The Regulatory Landscape

The regulatory landscape surrounding traditional and tokenized shares is vastly different. Traditional stocks operate under well-established legal frameworks designed to protect investors. Tokenized shares, however, exist in a nascent regulatory environment, with varying levels of protection depending on the platform and token type. While this dynamic offers flexibility and innovation, it also introduces additional risk for investors due to the potential lack of clear legal recourse.

VIII) Tokenized Shares Come with New Risks

Both systems also present security risks, with traditional systems facing hacking and fraud, while tokenized platforms grapple with smart contract vulnerabilities and exchange security breaches.

Beyond the Basics: Additional Considerations

Several other factors differentiate traditional and tokenized shares. Some tokenized shares may not offer voting rights like traditional stocks, and distributing dividends can be more complex in the tokenized world. Both systems also present security risks, with traditional systems facing hacking and fraud, while tokenized platforms grapple with smart contract vulnerabilities and exchange security breaches.

Example: How Tokenization Can Expand Islamic Real Estate Investment for Smaller Institutions

Islamic banking banks typically buy building projects and resell them to the buyer with a markup, instead of giving out loans. This process works well but includes an extra asset transfer, making it complex and only feasible for large banks that can afford entire projects. However, tokenizing large real estate projects could also allow smaller and mid-sized institutional investors to enter the market.

Making the Choice: Balancing Innovation and Established Systems

The world of share ownership is at a crossroads. While tokenized shares offer innovation, faster settlement, and potentially lower fees, they also exist in a less regulated environment with evolving technology and higher inherent risks. Traditional stocks, on the other hand, provide established regulations, investor protection, and high liquidity, but with limitations in accessibility and potentially higher fees. Ultimately, the choice between these two modes of ownership depends on your individual investment goals, risk tolerance, and technological comfort level. Thorough research and due diligence are crucial before diving into.

In conclusion, while traditional and tokenized shares share similarities in their function as investment instruments, they diverge significantly in their underlying assets, trading platforms, accessibility, settlement times, fees, regulation, and liquidity. Investors must carefully consider these dimensions when choosing between the two options, weighing the advantages and disadvantages to align with their investment goals and risk tolerance.

Published in Crypto, Tokenization on 13.03.2024 18:21 Uhr.

E-Mail address

Comment *