Frank Schwab

I bridge the gap between Visionary

Technology and Balance Sheet Profitability

The Rise and Abrupt Wind-Down of Jenius Bank

The Cost of Ambition: Why SMBC’s Jenius Bank Failed to Crack the U.S. Consumer Code

Executive Summary: A Giant’s Retreat from Main Street

In January 2026, the Japanese banking titan Sumitomo Mitsui Financial Group (SMBC) made the abrupt decision to shutter Jenius Bank, its U.S. digital-only consumer division. The move marked the end of a three-year experiment designed to capture American retail deposits without the overhead of physical branches. Despite achieving rapid growth—amassing over $1 billion in deposits and $1 billion in loans in under 24 months—the division fell victim to a classic "profitability trap." Burdened by an expensive enterprise technology stack and the high cost of buying customers in a saturated market, Jenius Bank could not transition from a cash-burning startup to a sustainable business. The closure, which displaced roughly 170 employees, signals SMBC's strategic pivot away from consumer speculation back to its core strengths in corporate and investment banking.

Strategic Context: Seeking Growth Beyond Japan’s Stagnant Borders

To understand why Jenius Bank existed, one must first look to Tokyo. For decades, Japanese "megabanks" like SMBC have battled a domestic environment defined by negative interest rates and an aging population. The United States represented the opposite: a dynamic, high-margin market with a growing consumer base.

SMBC’s strategy was not to buy a legacy bank, but to build a modern one. Operating as a division of SMBC MANUBANK (its California-based commercial arm), Jenius Bank was conceived as a "neobank for the mass affluent." Unlike competitors chasing the underbanked, Jenius targeted prime borrowers and savers with a promise of "humanizing banking" through data-driven financial wellness. The goal was clear: use U.S. consumer deposits to fund U.S. corporate lending, creating a self-sustaining ecosystem.

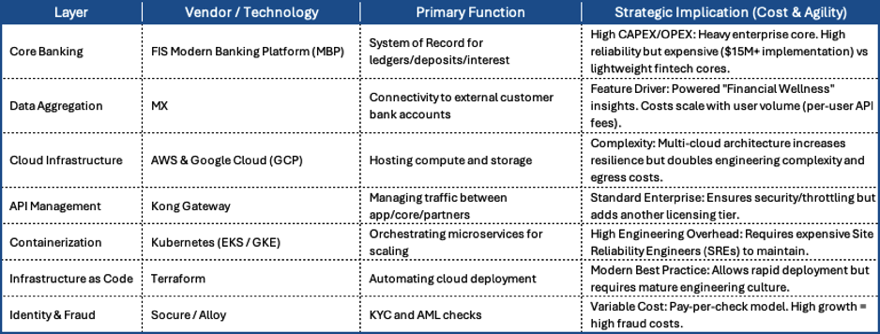

The Technology Trap: An Enterprise Stack Weighted Down by Cost

Most successful fintech startups begin with lightweight, flexible infrastructure to keep "burn rates" low. Jenius Bank took a different path, adopting a "Hybrid-Enterprise" strategy that prioritized scale and security over agility.

At its core lay the FIS Modern Banking Platform (MBP). While powerful, this system is a heavyweight, componentized enterprise ledger designed for massive institutions. Implementing it required an estimated $15–$25 million in upfront capital and 12–18 months of integration work. Surrounding this core was a complex ecosystem: MX for data aggregation to power "financial wellness" insights, Kong for API management, and a multi-cloud architecture spanning AWS and Google Cloud.

While this stack provided stability and regulatory compliance, it created a massive fixed-cost base. The bank had built a Ferrari engine for a vehicle that was still stuck in traffic; the high operating expenses (OPEX) of maintaining such a system meant the bank needed massive scale immediately to break even—scale that is expensive to buy.

#banking #strategy #digital #digitaljourney #neobank #failure

#casestudy

Financial Reality: The "Negative Carry" of Buying Growth

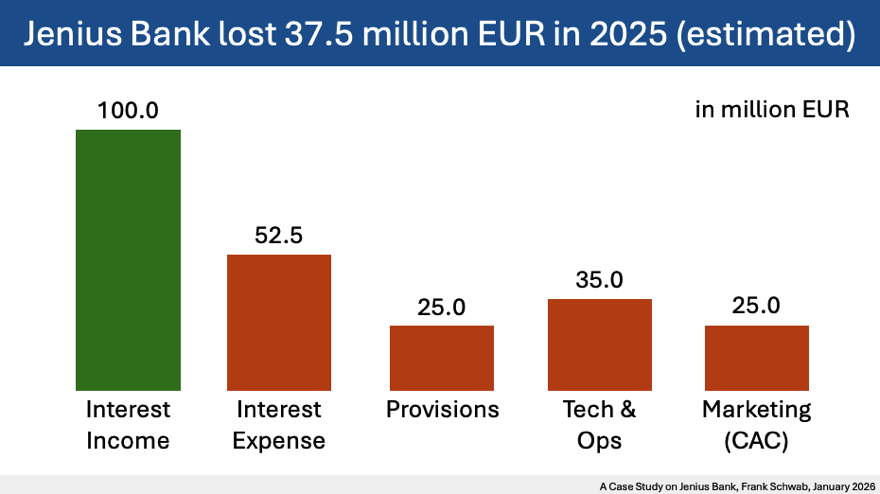

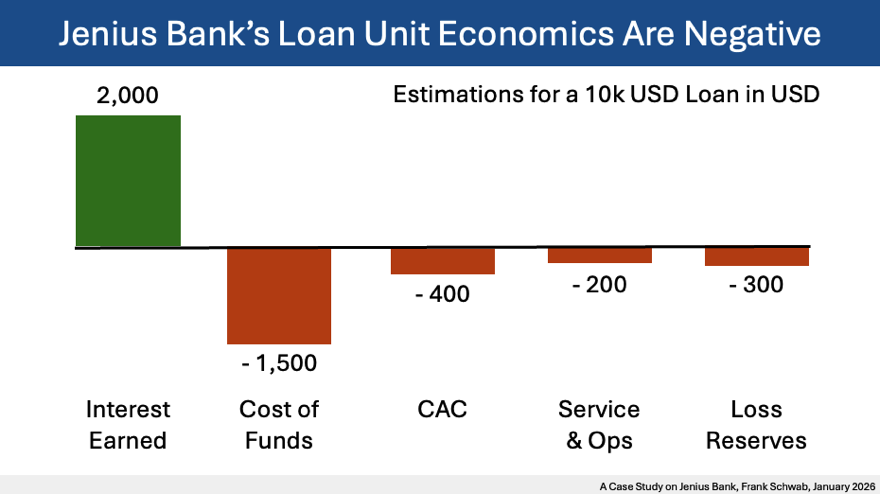

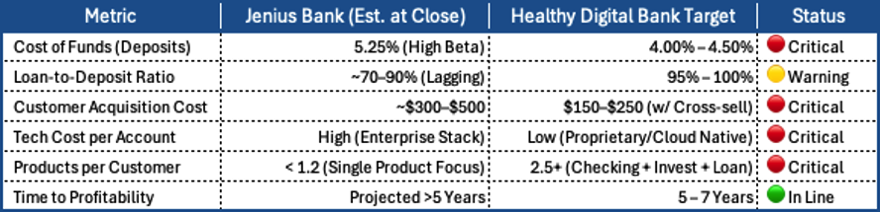

Jenius Bank proved it could grow assets, but the cost of that growth ultimately made the business model unsustainable. By May 2024, the bank had successfully attracted $1 billion in deposits and originated nearly $1 billion in personal loans. However, a closer look at the unit economics reveals why this volume was a liability rather than an asset.

To attract deposits quickly, Jenius paid top-of-market rates, launching its savings product with an APY of 5.25%. This created an immediate interest expense of roughly $52.5 million annually. Simultaneously, to generate loans, the bank had to spend heavily on digital marketing and affiliate fees, with customer acquisition costs (CAC) estimated between $300 and $500 per funded loan.

The result was a "negative carry." The spread between the interest earned on loans (assets) and the interest paid on deposits (liabilities) was too thin to cover the massive technology costs and marketing spend. In its final reporting period, the division posted an operational loss of $37.5 million. It became clear that Jenius was effectively subsidizing U.S. consumers with Japanese shareholder capital, with no clear path to profitability in the near term.

The End Game: A Swift Strategic Pivot Over Sunk Costs

The decision to wind down operations in January 2026 was driven by a shift in philosophy at the parent group level. SMBC Group’s leadership in Tokyo began prioritizing Capital Efficiency and Return on Equity (ROE) over raw volume.

Faced with the prospect of bleeding cash for another 3–5 years to reach a "break-even" scale, SMBC chose to cut its losses. The bank filed a WARN notice in January 2026, announcing the layoff of approximately 161 to 175 employees, including the C-suite and engineering teams. Operations were suspended immediately: new account openings ceased, and the $1 billion loan portfolio was earmarked for sale or absorption into the wholesale book.

Conclusion: The Dangers of Being a "Generalist" in a Specialized Market

The failure of Jenius Bank serves as a cautionary tale for foreign entrants in the U.S. market. It highlights the difficulty of the "Build" strategy versus the "Buy" strategy. By trying to build a brand from scratch, SMBC incurred all the startup costs of a fintech without the agility, while carrying the regulatory burden of a bank.

Ultimately, Jenius Bank did not fail because its technology didn't work or because customers didn't want the product. It failed because the cost of delivering that product exceeded the revenue it could generate. The wind-down validates a return to specialization: SMBC is retreating to its fortress of strength—wholesale and investment banking—leaving the expensive battle for the American consumer to those with the scale to survive it.

References & Sources

SMBC Group (SMFG) Investor Relations: Annual Reports & Strategic Filings (2025/2026) Link

Grand Pinnacle Tribune (Jan 13, 2026): "Jenius Bank Shutters; SMBC Pivots Strategy" (Confirmed $38.3M loss figure) Link

Retail Banker International (Jan 13, 2026): "SMBC Group to Close US Digital Unit Jenius Bank" (Confirmed layoff numbers and WARN notice) Link

Banking Dive (Jan 9, 2026): "Jenius Bank is Winding Down" (Employee interviews regarding profitability timelines) Link

Jenius Bank Press Release (May 2024): "Jenius Bank Surpasses $1 Billion in Deposits" (Confirms growth metrics) Link

MX Client Stories: "How Jenius Bank Humanizes Digital Banking" Link

FIS Global Case Studies: "Jenius Bank Launches with FIS Modern Banking Platform" Link

© Frank Schwab 2026