From Oversight to Architects of Digital Resilience - DORA Reshapes the Board's Role

The accelerating pace of digital transformation in the financial sector has fundamentally altered the landscape of risks faced by banks. Operational disruptions caused by cyberattacks, technology failures, or third-party dependencies have the potential to trigger systemic crises across the interconnected financial system. In response to these evolving threats, the European Union's Digital Operational Resilience Act (DORA) represents a watershed moment, establishing a harmonized framework to enhance the sector's ability to withstand and recover from digital disruptions. For supervisory board members of banks, DORA signifies a call to action, demanding a renewed focus on digital operational resilience and a comprehensive oversight approach.

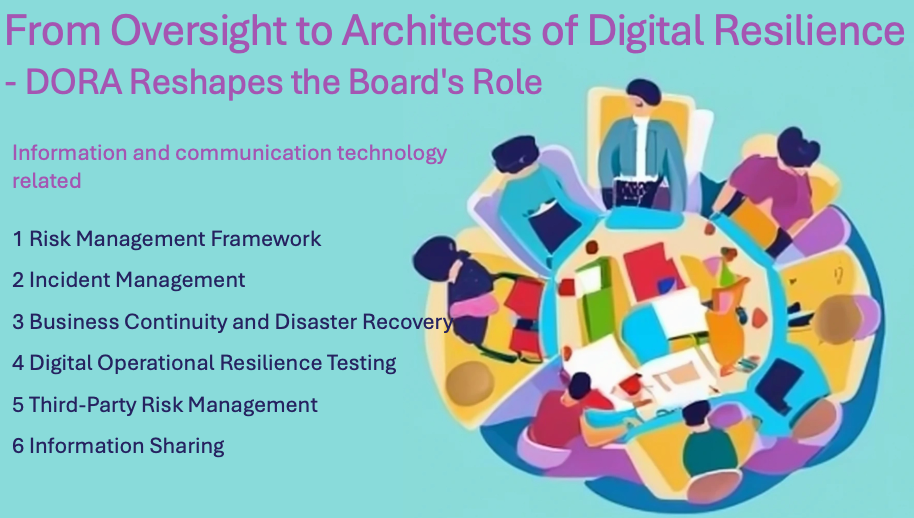

DORA goes beyond existing cybersecurity regulations by mandating in-depth ICT (Information and Communication Technology) risk management across the entire financial ecosystem. Supervisory boards hold the primary responsibility for ensuring their institutions are adequately prepared for the challenges posed by DORA. This entails a profound understanding of the regulation's core principles, a strategic recalibration of risk management approaches, and a commitment to fostering a culture of resilience across all organizational levels.

One of the most critical functions of supervisory boards in the wake of DORA is the implementation of a robust ICT risk management framework. Board members must not only approve ICT-related policies and procedures but also actively monitor their effectiveness. This requires a shift in mindset, recognizing that ICT risk is not a purely technical issue but a fundamental business risk. Boards need to ensure a holistic view of the institution's digital footprint, mapping critical business functions and identifying potential vulnerabilities stemming from internal systems, external dependencies, and the ever-evolving threat landscape.

Effective ICT incident management is another cornerstone of DORA compliance. Supervisory boards must play a crucial role in defining incident reporting thresholds, escalation procedures, and communication protocols with both internal and external stakeholders. DORA emphasizes the need for swift and decisive action in the face of disruptions, as well as thorough analysis of root causes to prevent future recurrences. Board oversight in this area helps drive continuous improvement in the institution's ability to manage operational crises.

Furthermore, DORA spotlights the interconnected nature of risk within the digital financial ecosystem. The reliance of banks on a complex web of third-party ICT service providers introduces a unique dimension to risk management. Supervisory boards must ensure that meticulous due diligence processes are in place for the onboarding of new third-party providers and that contractual agreements explicitly address issues of ICT risk and operational resilience. The oversight role must extend beyond initial contracting, demanding the institution maintains continuous monitoring of its third-party relationships.

The implementation of DORA goes beyond technical compliance; it necessitates a culture where digital operational resilience is a top priority. Supervisory boards are best positioned to lead this cultural transformation. Through communication, incentives, and accountability mechanisms, board members can promote resilience-focused behavior across the organization. This translates into investing in robust technologies, proactively identifying and mitigating risks, and emphasizing the importance of effective incident reporting and response.

Effectively navigating the requirements of DORA requires board members to expand their knowledge and expertise. This may mean including individuals with deeper technical backgrounds in cybersecurity or digital risk management or seeking external advisors to support the board's decision-making. Additionally, remaining abreast of evolving regulatory expectations, industry best practices, and the changing threat landscape is essential for informed and proactive oversight.

In conclusion, the Digital Operational Resilience Act (DORA) marks a significant milestone in the evolution of the European financial regulatory landscape. For supervisory boards of banks, it demands a shift in focus and strategy. By embracing the core principles of DORA, fostering a culture of resilience, and driving the development of robust ICT risk management frameworks, supervisory boards can safeguard their institutions and contribute to the overall stability of the financial system.

Published in DORA, digital, banking, digital, banking, supervisory, board on 15.04.2024 19:07 Uhr. 0 comments • Comment here